2022 is bound to be a turbulent year, from surging core tides to "core fatigue". The epidemic situation has intensified and international conflicts have erupted, which has seriously affected the industry. Although this is the case at present, the moon is sunny and the tide fluctuates, and the chip market is too cyclical. I hope you can keep your strength up and welcome the next heyday.

Since the fourth quarter, the demand has focused on the automotive and Internet of Things industries, and the supply of consumer chips is sufficient. But with the new energy vehicles and the Internet industry driving, the next new cycle will come soon!

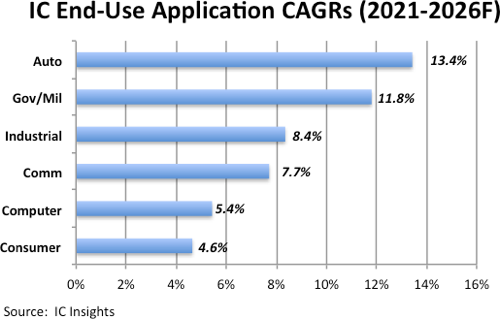

In a report released by Automotive News, the rapid growth of electric vehicle sales in the first three months of 2022 has made the share of electric vehicles in new vehicle sales in the United States reach about 5%. Of the approximately 250 million cars and light trucks in the United States, it is estimated that only 1% are electric, but user interest and sales will continue to grow. These factors are expected to lead to the highest CAGR of 13.4% in any major end use sector of the automotive market from 2021-2026

At present, STMicroelectronics' demand is still very weak. Customers are still waiting on the price trend, and the order rate is low. In terms of demand, the demand for STM32F series MCU is relatively large, the supply of STM32F030 and F103 series MCU is sufficient, and the price has dropped to a relatively stable point, slightly down. There is a lot of demand for vehicle specification grade MCU and driver products, and there is an obvious shortage. You can pay more attention to it. In terms of delivery date, the overall delivery date of STM still shows no signs of easing, but after the client demand decreases significantly, the pressure on the subsequent supply side may decrease a lot. Our company has long-term demand for ST, if there is an advantageous part number, welcome to exchange.

The overall demand of Qualcomm is still very small, and most clients hold a wait-and-see attitude, waiting for the price to return to the normal level. However, since the beginning of this month, Qualcomm will increase the price of all products by about 15%, which is expected to affect the subsequent market price trend. In terms of demand, the supply of consumer products is saturated, the demand drops significantly, and there are many spot goods. CSR Bluetooth chip BC417 is in great demand, but the market price is very high. Some of the network red ink router chips AR8033-AL1A have been released in the market, but the price is still high. The AR8035-AL1B industrial grade and QCA8337N-AL3B are the main products out of stock this month, and there are few in stock.

With the continuous downturn of the whole industry, the demand of Broadcom has not recovered in the past month. Customers usually receive more goods. Large scale arrival of goods leads to the gradual increase of factory inventory. In the next six months, the factory side will be a very good supply channel. At present, the demand of communication customers is relatively low, and the demand of server customers is not as good as that in the first half of the year. At present, there are a few PLX series of goods, so customers are not willing to place orders. The demand of automobile customers is relatively good, but because the supply is relatively normal, there are fewer shortage opportunities and more price drops.. In the near future, the finished products will be relatively low. On the one hand, there is less demand. On the other hand, the supply side is still in a high expectation, while the client side is holding a wait-and-see attitude, and the subsequent spot traders can adjust their quotation mentality appropriately.

The delivery date of Renesa products eased in October, but it was still relatively long overall, more than 40 weeks. In terms of demand, the consumer demand has declined significantly, the agent end has arrived in succession, and the market price has decreased. The demand for material shortage is still concentrated in the automotive and industrial fields. Shortage series, such as R5F10/R5F5/R5F6, etc. In addition, the supply of clock buffers is seriously affected by the insufficient supply of crystal raw materials and the limited capacity. The delivery period of 5P8/5P1/8P3 series is still long, and materials are mainly distributed. Renesa has a lot of market demand, and you are welcome to exchange superior materials.

In October, the market demand of TI warmed up, the terminal backlogs were arriving, and the vehicle gauge materials were still out of stock, especially the ISO, TPS, DS90 and other series. The prices were generally high, and the scheduling cycle had been extended to more than 40 weeks. In addition, according to market news, TI will start a new 300 mm wafer factory at the end of the year to deal with the shortage of vehicle gauge market.

There is not much demand for NXP conventional materials this month, and the out of stock products are mainly concentrated on the MCU of automobiles and medical equipment. In terms of delivery date, a large number of consumer materials have arrived. At present, the stock is sufficient. The delivery date of the industrial series is 52-78 weeks. The delivery date of the TJA series has also returned to normal. 1. Although the shortage of MX series has been alleviated, the prices of most models are still at a high level. The demand for car chips such as S912xxx and S9Sxxxx is still soaring. NXP said at the recent performance briefing that as new energy vehicles will enter the accelerated penetration stage, the subsequent situation of short supply will bring NXP successive orders. According to the current and 2023 NCNR orders, 20% of NXP's current capacity orders cannot be covered. At the same time, because the supply and demand relationship cannot be eased in a short time, NXP has sufficient confidence in the price. Following the price increase in early July, NXP plans to increase again at the end of this year, with the industrial control category expected to increase by about 10%, the automobile category expected to increase by about 20%, and the consumer category not.

In terms of ADI, the delivery plan of backlog is still slow, affecting various product families, and the delivery is seriously delayed. At present, the average delivery time is about 45 to 48 weeks. ADI is monitoring their public backlogs and refusing delivery orders to avoid repeated orders. For automobile and server products, the delivery time is 70-80 weeks, the supply situation is still tight, and the market is obviously out of stock, such as ADUMxxx, ADAxxxx, etc. The supply of Linear automotive products is also tight, with an average delivery time of more than 52 weeks, such as LTC 8609, LTC1859, etc. In terms of Maxim, the delivery period of amplifier products has been extended to 60 weeks, with obvious shortage, and the demand for automotive products is still strong. The MAX 40, 44, 96 and 99 series are still in short supply.

In terms of microchip, the overall demand in October increased compared with the previous month, but the demand is mainly concentrated on automotive materials products, and the demand for consumer and industrial products is not much. In terms of delivery date, the delivery date of 8-bit 32-bit MCU is still more than 52 weeks, especially the delivery date of the vehicle gauge video and image controllers is more than 70 weeks, such as PIC32MZ1024 series. The delivery date of Ethernet controller is 30-52 weeks. There is a lot of market demand and the price fluctuates greatly, such as KSZ9031 series and PD6920 series. Microchip memory, especially EEPROM products, are in short supply at present. Some products have a delivery date of more than 80 weeks, and the market price has increased significantly. In addition, the FPGA delivery time of Microchip is generally long, and there are few spot products in the market in 42-52 weeks. It is expected that the shortage of Microchip microcontroller and high-end analog products will not be eased until the end of 2022.

At present, Onsemi's demand is mainly focused on automotive materials. In addition to the previous NCP and NCV series, which have increased prices a lot, there is also a lot of demand for vehicle specification level MOSFETs. The market price is at a high level, such as NVM, NVTF, NRVTS and other series, which can be concerned. In addition, in industrial, medical and other fields, the delivery date of MBRA, MBRS and other series of discrete devices has been extended, and the spot market price has risen significantly. In terms of LogicGate, NC7 series and MC series are still out of stock. This series has a wide customer base and the spot market price is still high. However, part of the reason for the price increase of these series is that TI's logic chip series, such as SN74 and SN65, are out of stock in a large area. Once TI's shortage problem is alleviated, the spot market price will decline.